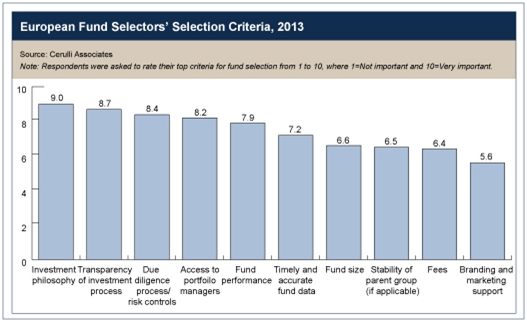

In Cerulli's most recent proprietary survey, two-thirds of European fund selectors rated investment philosophy as their most important selection criteria of third-party asset managers

Cerulli's inaugural European Fund Selector report finds fund selectors of all colors share a common burden. Across Europe, investment philosophy, transparency, and due diligence process are the three most important criteria to getting a foothold on a selector's buy list.

Articulating investment philosophy is by far the most important consideration in the selection process. Despite this, many selectors report that in general asset managers fail to do this, particularly on the Continent. "Although most selectors prefer direct contact with the portfolio managers, other key players in the selection process can relieve the burden, such as product specialists-a mixed bag ranging from laudable American players to those that are more hindrance than help", says Fiona Maciver, a Cerulli associate director, and one of the authors of the report.

The report explores the biggest cause for concern among selectors, and what prompts them to take a product off a buy list. Concerns such as transparency are paramount-73% of Swiss selectors report transparency as their most important selection criteria, for example.

Apart from a strong product, risk control continues to be increasingly important but on the whole fund selectors continue to invest in people-maintaining relationships is vital. As such, 64% of respondents said a departing portfolio manager is their top reason for removing a fund from a buy list.

"Central buy lists have dramatically reduced in size over the past decade and with massive time and resource constraints, navigating product proliferation is a tough job for any buyer. A typical fund analyst can cover up to 30 managers, but with a significant number of selection teams numbering two or three people, competition for shelf space is fierce", says Philip Holton, a Cerulli analyst and one of the authors of the report.

The research also discusses the shifting regulatory landscape and its effects on data reporting and transparency, remuneration, and distribution costs. Portfolio manager retention is vital so pay structure could prove a testing ground for those adapting to potential changes in remuneration.

In context of the pressures that buyers and sellers experience, European Fund Selector 2013 discusses how asset managers should best approach fund selection.

---------- découvrir les lettres et newsletters d'Esteval Editions ----------